A Pension Strategy That May Boost Your Income

If you have a traditional pension — also called a defined benefit plan — when you retire, your plan may offer several payout options, including a qualified joint and survivor annuity (QJSA) if you are married. A QJSA is an annuity that pays a dollar amount (usually monthly) for the rest of your life, with at least 50% of that amount continuing to your spouse after your death.

If your spouse consents in writing, you can waive the QJSA and elect instead to receive a single-life annuity. With this option, payments are made over your lifetime but stop upon your death. Single-life annuity payments are generally significantly higher than QJSA payments, but your spouse would receive no pension benefits after your death.

Life insurance strategy

A strategy called pension maximization may offer the best of both worlds. Using this strategy, your spouse waives the QJSA and you elect the single-life option. You and your spouse then use the additional pension income to purchase insurance on your life, with your spouse named as beneficiary. If you die first, the pension payments will stop, but your spouse will receive the life insurance death proceeds free from federal income tax. By coupling the larger pension payments with a life insurance policy, you might increase your total income during retirement, while also providing for your spouse’s financial future if you die first.

Questions to ask

Here are some factors to consider before implementing this strategy.

- Are you insurable? If not, pension maximization is not a viable strategy.

- How much will the life insurance cost? If you are relatively young and in good health, the insurance premiums may be much more affordable than if you are older and/or in poor health.

- How much more does the single-life annuity pay than the QJSA? The larger the benefits under the single-life annuity, the more life insurance you may want to buy to replace the income — and the more extra income you may have to pay the premiums. Also factor in any cost-of-living adjustment the pension plan might provide when analyzing your payment options.

- How healthy are you and your spouse, and what are your life expectancies? The pension maximization strategy works best if the person receiving the single-life annuity lives a relatively long time, receiving the higher monthly pension payments. On the other hand, the longer your spouse lives after your death, the more valuable the spouse’s pension payments under the QJSA option might be.

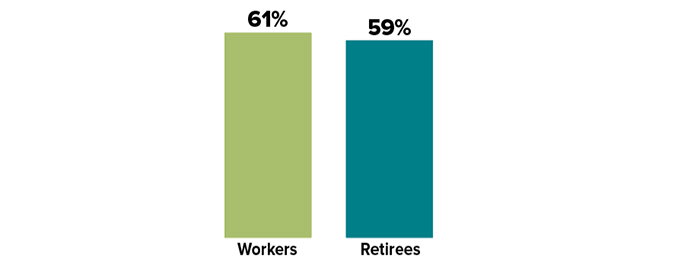

Expecting a Pension?

Although pensions are no longer common in private industry, they have not disappeared, and they remain a mainstay in the public sector. In a 2024 survey, about three out of five workers and retirees expected a traditional pension or defined benefit plan to be a source of retirement income.

Source: Employee Benefit Research Institute, 2024

Tax considerations

Pension benefits are generally treated as taxable income, subject to federal (and possibly state and local) income tax. This is true regardless of whether you elect a single-life annuity payout or a QJSA. However, because the pension benefits are larger with a single-life annuity, electing that option will increase your taxable income during retirement. If you elect the QJSA option, the pension payout to the survivor will be included in the survivor’s taxable income.

If you use the pension maximization strategy and die before your spouse, the life insurance death benefits will not be included in your surviving spouse’s taxable income, because life insurance death benefits generally pass free of income tax to the beneficiary of the policy. Of course, any earnings from investing the life insurance proceeds may be taxable.

Choosing a pension payout option and life insurance coverage can be complex and will impact the financial future of you and your spouse. Be sure to seek qualified professional guidance.

There are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. Any guarantees associated with payment of death benefits, income options, or rates of return are based on the financial strength and claims-paying ability of the insurer. Policy loans and withdrawals will reduce the policy’s cash value and death benefit.